Investing in Southeast Asian Startups: A Guide for Investors

Dreaming about the next unicorn startup? Well, maybe it’s time to divert your gaze from Silicon Valley and direct it towards Southeast Asia (SEA). Yes, you read that right! The startup ecosystem in SEA is buzzing, and if you’re not tuned in yet, you might just miss out on the next big thing. Let’s dive in and discover what’s brewing in this vibrant region.

Why Southeast Asia?

In the past decade, Southeast Asia has emerged as a hotspot for startup activities. With a population of over 650 million and a rapidly growing middle class, the region presents a huge market opportunity. According to a report by Google and Temasek, the digital economy in SEA is expected to surpass $300 billion by 2025. Impressive, right?

A combination of factors such as increased smartphone penetration, young demographics, and a rising digital economy has made SEA a magnet for both local and foreign investors. Plus, let’s not forget about the success stories like Grab, Gojek, and Tokopedia, which have showcased the immense potential of this region.

Diverse Opportunities Across Nations

Southeast Asia isn’t just a monolithic entity when it comes to startup potential. Each country in this vibrant region boasts its own unique strengths, challenges, and areas of growth. To truly understand the vast tapestry of opportunities in SEA, we need to zoom into some of its key nations:

Singapore: The Business Beacon

Beyond being called the “Silicon Valley of Asia”, Singapore offers a strong financial hub, world-class infrastructure, and a highly-skilled workforce. It also serves as a gateway for foreign startups and investors looking to penetrate the SEA market. Its government is highly supportive, rolling out numerous startup grants and schemes regularly.

Indonesia: The Archipelago of Potential

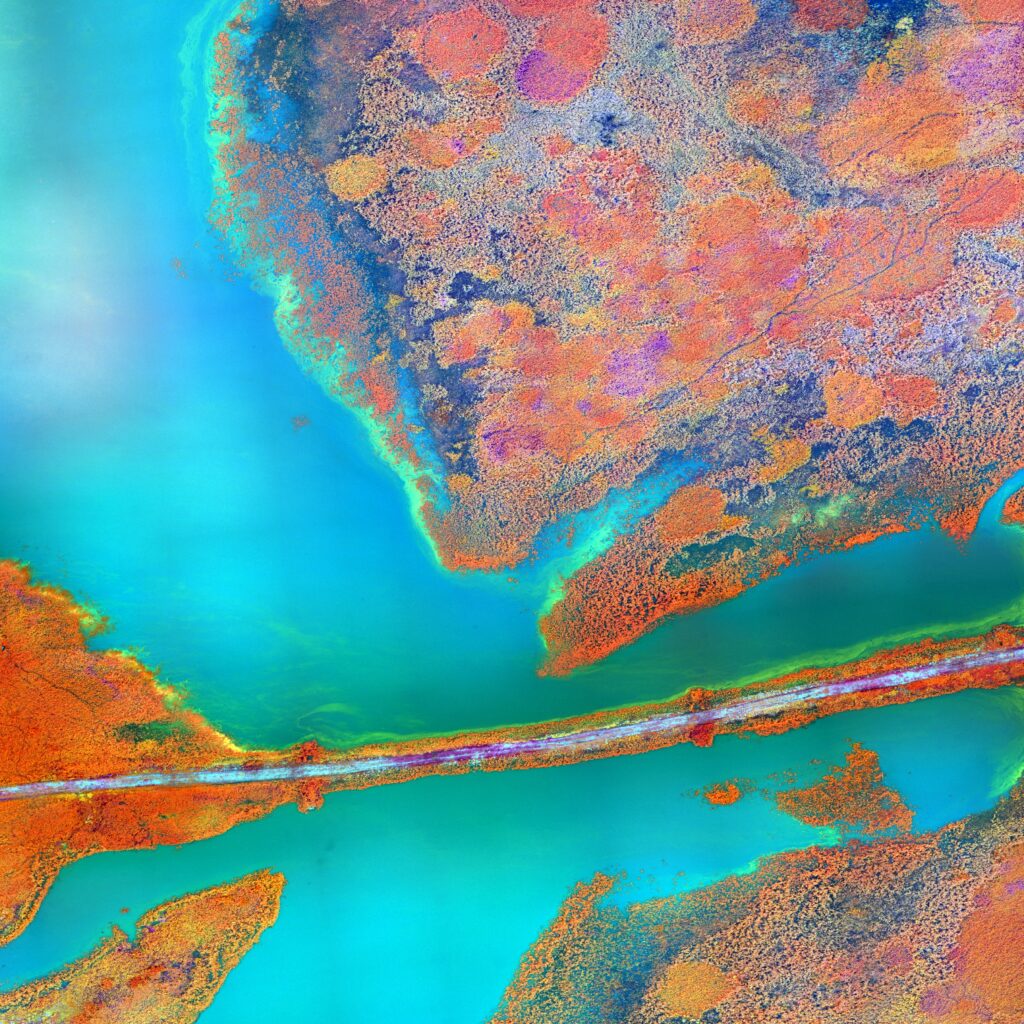

Indonesia isn’t just about Gojek or Tokopedia. The vast archipelago offers opportunities from its urban centers like Jakarta to its emerging cities. Tourism tech, agritech, and sustainability solutions are particularly promising, given the nation’s rich natural resources and diverse landscapes.

Vietnam: The Emerging Tech Powerhouse

In recent years, Vietnam has been showing an impressive growth rate in the tech sector. Its young, digitally-forward population is increasingly looking for tech solutions in daily life. Not just in e-commerce or fintech, but in areas like gaming, e-sports, and social commerce. Companies like VNG Corporation, a leader in online gaming, are prime examples of this shift.

Philippines: BPO and Beyond

While the Philippines has made a name for itself in the Business Process Outsourcing (BPO) sector, it’s rapidly moving beyond this. Startups in the archipelago nation are making strides in sectors like healthtech, e-commerce, and digital entertainment. With its English-speaking population and cultural affinity to the West, it’s an attractive base for startups aiming for a global audience.

Malaysia: The Middle Ground

Often acting as the bridge between the East and West, Malaysia’s startup scene is eclectic. Its capital, Kuala Lumpur, is a bustling hub for fintech and e-commerce startups. Moreover, the Malaysian government’s push for digital transformation, through initiatives like the Malaysia Digital Economy Blueprint, adds to its allure.

Thailand: The Tourism and Tech Tango

While globally known for its breathtaking beaches and tourism, Thailand’s startup ecosystem is thriving, especially in Bangkok. Traveltech, agritech, and property tech startups are finding their niche in this beautiful kingdom. The Thai government’s “Thailand 4.0” initiative, which emphasizes technological innovation, further fuels this momentum.

Challenges and Considerations

As with any promising frontier, Southeast Asia isn’t just a bed of roses. While it offers a treasure trove of opportunities, there are some critical challenges and considerations that investors need to be acutely aware of. So, before you set sail on your investment journey in SEA, here’s what you need to watch out for:

Cultural Diversity: The Southeast Asian region is incredibly diverse. With ten countries, each boasting its own unique culture, languages, and business practices, it can be a maze to navigate. Misunderstandings stemming from cultural nuances can lead to misaligned expectations or even jeopardize business dealings. It’s more than just ‘knowing your market’; it’s about understanding people.

Regulatory Hurdles: Each SEA country has its own set of business regulations, and they can be quite different from what you might be used to. While Singapore may offer a friendly regulatory environment, other countries might pose more significant challenges. It’s vital to do thorough research or even better, to have local legal counsel on hand to guide through the intricacies.

Competition and Valuations: The allure of the SEA market isn’t a secret. With an increasing number of investors flocking to the region, competition is fierce. This has led to higher valuations, and in some cases, bubbles. Ensuring you’re not overpaying for potential is critical.

Infrastructure Variability: While countries like Singapore and Malaysia boast advanced infrastructures, other parts of the region may lag. Issues like inconsistent internet connectivity, transportation bottlenecks, and power instability can impact the scalability and operations of startups.

Talent Scarcity: While there’s no shortage of enthusiasm and entrepreneurial spirit, there’s a noted scarcity of seasoned tech talent in some parts of SEA. Building a solid team is a challenge that many startups face, which can impact their growth trajectory.

Tapping into the SEA Startup Ecosystem

Venturing into the Southeast Asian startup scene requires a bit more than just a keen interest. The dynamics here are uniquely intertwined with cultural, digital, and economic pulses that run throughout the region. If you’re thinking about diving in, it’s vital to understand the intricacies of this intricate web. So, let’s unravel the strategies to tap effectively into the SEA startup ecosystem.

Collaborative Ventures

Rather than going solo, consider collaborative approaches:

Joint Ventures: Partnering with local businesses can provide a smoother entry into the market. They already have a feel for the landscape, and their local expertise can prove invaluable.

Acquisitions: If there’s an existing startup that aligns with your interests and has shown potential, acquiring can be a quicker route than starting from scratch.

Stay Updated with Market Trends

Regular Market Research: With the digital landscape evolving rapidly in SEA, it’s crucial to keep your fingers on the pulse of the market. Regular market research can offer insights into changing consumer behaviors, emerging trends, and potential challenges.

Engage with Local Communities: Join local entrepreneur communities, forums, and online groups. Platforms like e27 in Southeast Asia provide regular updates on the startup scene, funding news, and more.

Establish a Strong Local Network

Building a robust local network is not just a strategy; it’s an essential pillar for success in Southeast Asia. In many parts of the region, the adage “it’s not what you know, but who you know” holds a lot of weight.

First and foremost, mentorship plays a vital role. Having a seasoned local entrepreneur or business leader guide you can significantly expedite your learning curve. They can provide invaluable insights, from understanding local business etiquettes to navigating bureaucratic red tape.

Moreover, consider joining or participating in business associations and chambers of commerce. These platforms often host events, workshops, and seminars, acting as a melting pot for business leaders, innovators, and investors.

Understand Local Regulations

Each country in SEA has its own set of regulations regarding foreign investments, business operations, and more. It’s vital to get a clear understanding of these to avoid any legal complications down the road.

Engage with Local Regulatory Bodies: Before setting up or investing, engage with local regulatory bodies to understand the requirements. This not only ensures compliance but also establishes a good rapport with authorities.

Local Legal Consultation: Engaging with local legal consultants or firms that specialize in startup regulations can save a lot of hassle. They can guide you through the legal intricacies, ensuring smooth operations.

Where to Place Your Bets?

If you’re wondering which sectors to explore, here are a few that are sizzling with potential:

Fintech: With a large unbanked population and increasing internet penetration, fintech solutions have a vast market. Companies like OVO in Indonesia are revolutionizing payments and banking in the region.

E-commerce & Logistics: As more consumers turn online for shopping, there’s a growing demand for e-commerce platforms and efficient logistics. Lazada and Shopee are examples of companies dominating this space.

Edtech & Healthtech: With a young population hungry for knowledge and a growing demand for health services, startups in edtech and healthtech are gaining traction.

Wrapping Up

Investing in Southeast Asian startups is like embarking on an exciting journey. While there are challenges, the potential rewards are massive. With the right approach, local insights, and a dash of patience, you could be part of the next big success story from this vibrant region.

For more such articles, visit our articles section here – https://bbmagz.com/category/featured