Global M&A activity in “sweet spot” in 2023, says PwC

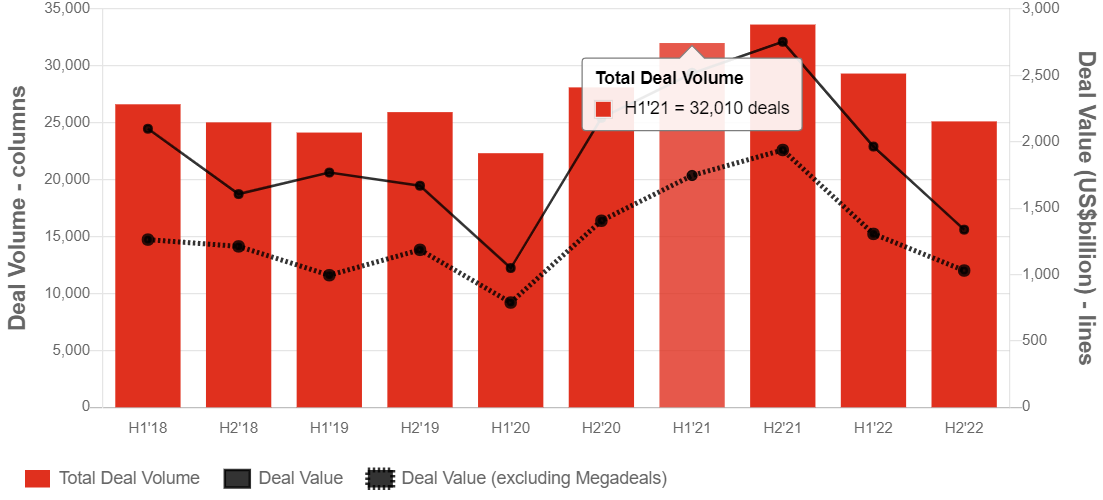

The global Merger and Acquisitions (M&A) activity registered a robust growth in 2021 with 65,000 transactions but it remained subdued due to rising inflation on account of geopolitical tensions in 2022.

Brands and Business Magazine

While the spurt in the 2021 deals is attributed to the low interest rates and pent-up demand during 2020, hike in interest rates, disruption in global supply chains impacted the M&A deals last year.

In its report entitled Global M&A Industry Trends: 2023 Outlook, the UK-headquartered PricewaterHouseCoopers (PwC), an international professional services brand of firms, expressed confidence that exciting M&A opportunities lie ahead this year.

“While overall deal volumes in 2022 were below the record-breaking 65,000 deals in 2021, they remained 9 per cent above pre-pandemic levels. The current market conditions suggest that we are in a sweet spot for M&A, if companies have well-thought-out strategies and the financial wherewithal (and in some cases the courage) to make transformational deals—deals that will shape their businesses and contribute to their longer-term success,” the report said.

The report further mentioned that in early 2023 the short-term economic outlook remained clouded by global recession fears and rising interest rates as central bankers tried to tame record inflation in many regions.

“When combined with edgy investors still digesting 2022’s steep decline in global stock market valuations, the war in Ukraine, other geopolitical tensions, supply chain disruptions and tightening regulatory scrutiny, it’s no wonder executives have been pushed back on their heels,” the PwC report said.

Brian Levy, Global Deals Industries Leader, Partner at PwC US, said, “Doing transformational deals in today’s climate is not for the faint of heart. However, with the right strategy, the right business case and the courage, CEOs can put some meaningful distance between themselves and their competitors in the long term.”

The report said that global M&A volumes and values declined in 2022 by 17 per cent and 37 per cent, respectively, although both remained above 2020 and pre-pandemic levels. The high levels of M&A activity from 2021 continued into the early part of 2022, but as headwinds continued to grow, each successive quarter reported a decline in deal activity over the prior one.

Deal volumes and values declined by 25 per cent and 51 per cent, respectively, in the second half of 2022 compared to the prior year period.

Asia Pacific

Deal volumes and values declined by 23 per cent and 33 per cent, respectively, between 2021 and 2022, with the greatest declines in China, where deal volumes and values decreased by 46 per cent and 35 per cent, respectively. M&A in China has slowed domestically in response to the country’s pandemic-related challenges and weakening demand for exports.

Companies seeking access to Asian markets are increasingly looking beyond China—to India, Japan, and other countries within Southeast Asia—for investment opportunities. India has emerged as an increasingly attractive destination for investment, overtaking Japan and South Korea in deal values to rank second in the region behind China.

Europe, the Middle East and Africa

M&A performed better in Europe, the Middle East and Africa (EMEA) than in the Asia Pacific and Americas regions, despite the impact on markets of higher energy costs and a drop in investor confidence.

Deal volumes and values across EMEA declined by 12 per cent and 37 per cent, respectively, between 2021 and 2022. With 20,000 deals in 2022, activity in the region was 17 per cent higher than pre-pandemic 2019 levels.

Americas

Deal volumes and values declined by 17 per cent and 40 per cent, respectively, between 2021 and 2022 due to a combination of macroeconomic, regulatory and geopolitical factors. Deal values were particularly hard-hit, and the number of US megadeals (transactions with a value of over $5bn) almost halved between 2021 and 2022 from 81 to 42, respectively.

The decline in the second half of the year was more acute, with just 16 megadeals in the second half of 2022 compared with 26 in the first half of the year, the report added.