Canada Pension Plan net assets grow to $570 billion in 2022-23

The Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on 31 March 2023, with net assets of $570 billion, compared to $539 billion at the end of fiscal 2022. The $31 billion increase in net assets consisted of $8 billion in net income and $23 billion in net transfers from the Canada Pension Plan (CPP).

Brands and Business Magazine

CPP Investments received greater than usual net CPP cash flows in fiscal 2023 due to higher employment rates, an increased limit to the year’s maximum pensionable earnings, an increase to additional CPP contribution inflows, and a lump-sum inflow in the fourth quarter due to forecasting adjustments made by the CPP, the Fund said in a release.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a net return of 1.3 per cent for the fiscal year. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than in single years. The Fund returned a 10-year annualised net return of 10 per cent. Since its inception in 1999, CPP Investments has contributed $386 billion in cumulative net income to the Fund.

John Graham, President & CEO of CPP, said that their strong long-term return of 10 per cent over 10 years demonstrated that their active management strategy was on track.

“Despite significant declines in global equity and fixed income markets during our fiscal year, our investment portfolio remained resilient, delivering stable returns while outperforming major indexes,” he noted.

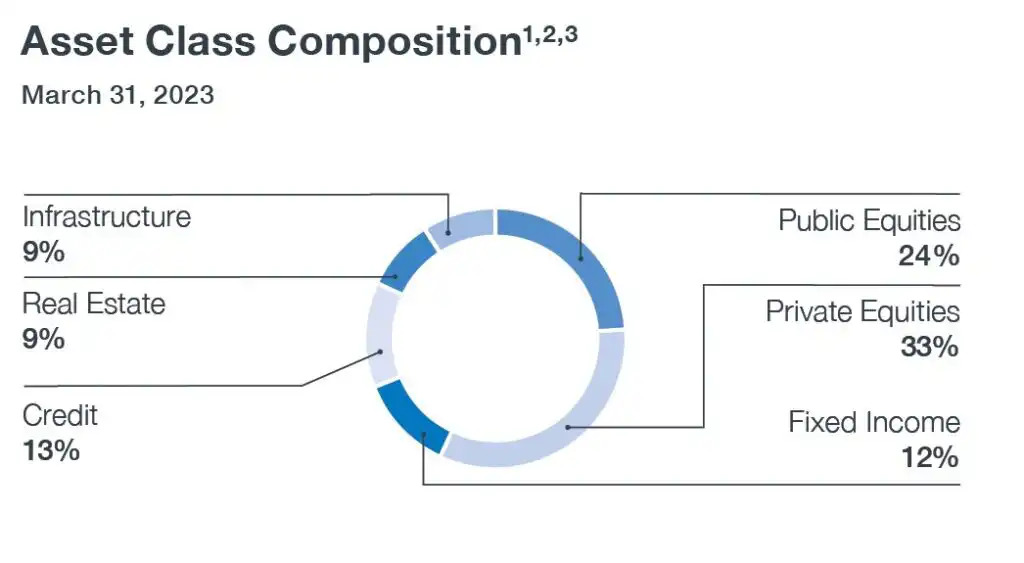

The positive fiscal-year results reflect returns on investments in infrastructure and certain U.S. dollar-denominated private equity and credit assets, which benefited from foreign exchange. External investment managers employing quantitative, equity, and fixed income trading strategies also contributed positively to results.

Our performance was partially offset by significant declines in both equities and fixed income across major markets as high inflation and rising interest rates weighed heavily on both asset classes. The Canadian dollar depreciated against the US dollar and other major currencies during the year, influenced by the impact of evolving monetary and fiscal policies across global economies. This had a positive impact on investment returns with a foreign currency gain of $25 billion.

Base CPP accounts

The base CPP account ended the fiscal year on 31 March 2023, with net assets of $546 billion, compared to $527 billion at the end of fiscal 2022. The $20 billion increase in net assets consisted of $8 billion in net income and $12 billion in net transfers from the CPP. The base CPP account achieved a 1.4 per cent net return for the fiscal year and a five-year annualised net return of 8 per cent.

The additional CPP account ended the fiscal year on 31 March 2023, with net assets of $24 billion, compared to $13 billion at the end of fiscal 2022. The $11 billion increase in net assets consisted of $331 million in net income and $11 billion in net transfers from the CPP. The additional CPP account achieved a 0.3 per cent net return for the fiscal year and an annualised net return of 5.6 per cent since its inception in 2019.

The additional CPP was designed with a different legislative funding target and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP, the Fund said.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account, the release added.