RCEP is a Gargantuan Trade Deal But Will Economies be Able to Make the Most of It?

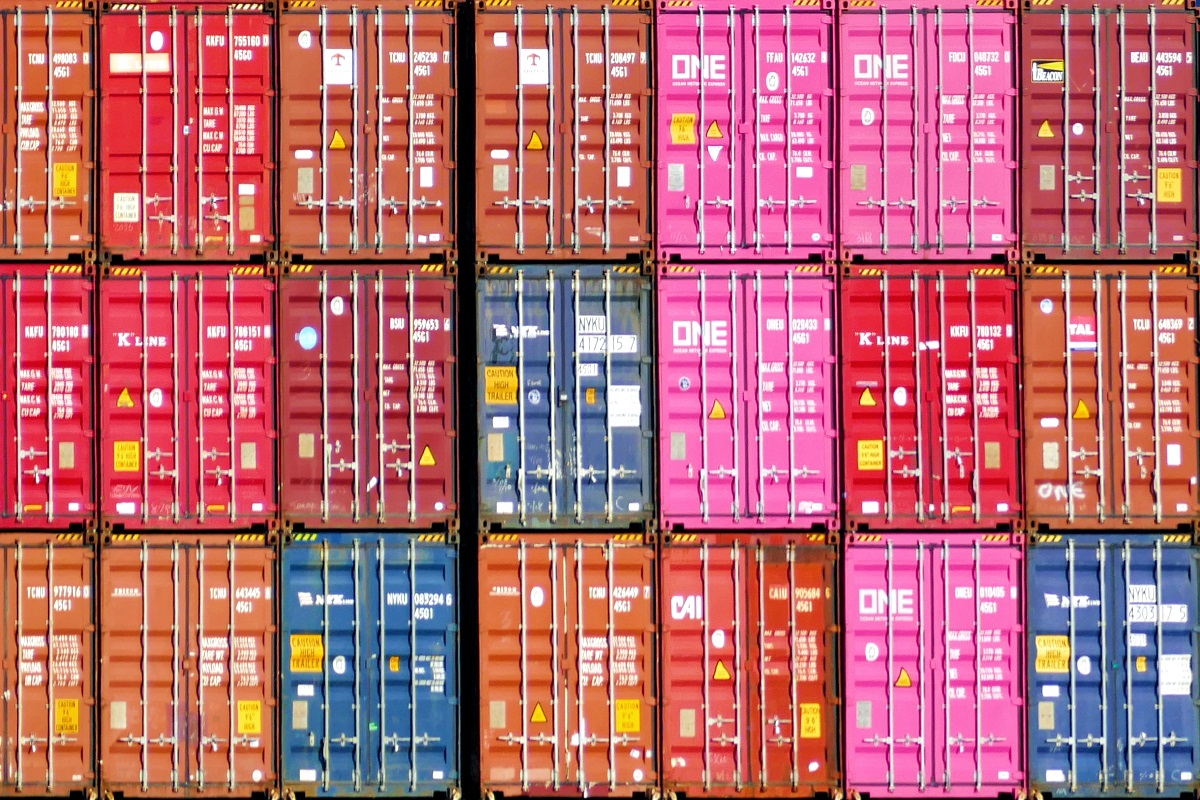

The Regional Comprehensive Economic Partnership brings 15 nations and 2.2 billion people into a trade partnership. It also offers broad economic and societal benefits that go beyond imports and exports.

The gargantuan trade pact known as the Regional Comprehensive Economic Partnership, or RCEP, could be a game changer for trade liberalization in the region. It partners Southeast Asian nations with Australia, the People’s Republic of China, Japan, New Zealand, and the Republic of Korea. The 15 nations and 2.2 billion people involved in the partnership account for 29% of global gross domestic product.

After eight years of talks, key negotiations on the partnership were finally signed on 15 November 2020, and will become effective once six members of the Association of Southeast Asian Nations, and three non-members, ratify the agreement. According to one recent study, real income increase for the world from the trade pact will amount to $186 billion by 2030.

Around $164 billion, a majority of the expected income gains from RCEP, are forecast to accrue to Asia, and in particular the People’s Republic of China, Japan and the Republic of Korea – the so called “plus three countries,” which are estimated to gain the lion’s share of the income gains at $156 billion.

This broad sketch of country level, regional and global welfare effect, while useful in gauging the overall economic gains, might obscure the greater potential to be unlocked through profound structural changes in the landscape of regional trade and value chain linkages created by this mega, regional trade deal.

An examination of global and regional value chains – the production networks that help drive trade in Asia and across the world – provides insights into why it is important to look below the surface at the structural links between the 15 RCEP member countries.

Asia’s regional value chain has deepened over time. Using ADB’s measurement based on its multi-regional input-output table data, Asia has seen regional value chain linkage increase from 46.6% in 2000 to 48.9% in 2018. An analysis of Asia’s more complex regional value chains show that they have increased as well, from 23.4% in 2000 to 26.2% in 2018.

Nevertheless, regional value chain linkages among members of the Regional Comprehensive Economic Partnership are much lower than the Asian average, reflecting relatively lower economic interconnectedness spanning a highly heterogeneous group of member countries. Overall, the regional value chain participation rate among the member countries remains at 46.8% and the complex regional value chain participation rate at mere 15.8% in 2018, much lower than the regionwide level (26.2%).

This means 46.8% of trade among RCEP members involves production stages spread over two or more economies within the group, and 15.8% of their trade entails intermediate goods crossing borders twice or more before final goods are exported.

For the overall regional value chain participation, Brunei Darussalam and Australia show the highest regional linkages, as major suppliers of natural resources. For complex regional value chains, ASEAN countries such as Malaysia, Singapore and Viet Nam have the highest participation rate—between 23% and 28%. Among non-ASEAN economies, the Republic of Korea followed by Japan demonstrate relatively higher regional value chain participation with RCEP members at 15%-18%.

Strengthening regional value chains is vital because it offers

economic and societal benefits that cascade not only across nations

but throughout the region.

While the traditional economic modeling exercises forecast the “plus three” countries will gain the most from RCEP due to their sheer economic size and comparative advantages in the higher-end, richer value-added segment of the industrial spectrum, this means ASEAN economies also could expect sizeable economic gains from RCEP.

Imagine a case where the tariff concession rate for a set of intermediate goods for the production of final goods between country A and B is determined at 10%. If these two countries are connected through a simple bilateral value chain, the expected tariff concession effect will be 10% only, but if they are connected through complex value chains, involving intermediate goods crossing the border twice or more before producing final goods, the effective tariff concession effect could be a multiple of two or more of 10%.

Conversely, the lower economic integration measured by regional value chain linkages among RCEP members at the moment suggests there could be huge gains due to strengthening value chain linkages from trade liberalization and facilitation under the partnership in the longer term. We may see their regional value chain participation rate among the members exceed the Asian average over time, as members take advantage of a simplified, common framework of rules of origin and regional cumulation of value contents. These will allow additional flexibility in mobilizing production networks within the RCEP region.

Strengthening and expanding these regional value chains is vital moving forward because it offers economic and societal benefits that cascade not only across nations but throughout the region.

In addition to reaping the gains from deeper regional economic integration, members could take the regional trading bloc as a springboard to deepen economic reforms and enhance the competitiveness of their industries. Such dynamic gains, which are difficult to capture through economic modeling, more often than not far exceed the numerical economic gains forecast.

A regional trading bloc should make sense not only for economic gains but from an environmental perspective as economic engagement among neighbors could leave smaller carbon footprints than arrangements with remote trading partners, other things being equal.

A big step toward a grand regional trading bloc has been made, yet how much economies are willing to seize the opportunity and transform this into future prosperity remains to be seen.

This blog post is based on data from the recently published Asian Development Blog.