Economic Resilience and Risks: Singapore’s Updated 2024 Growth Outlook

With a narrowed growth forecast, MTI highlights Singapore’s adaptive strategies amid international economic headwinds.

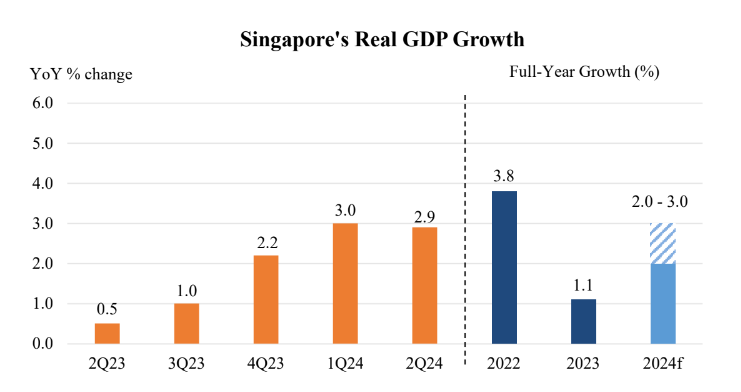

The Ministry of Trade and Industry (MTI) has revised Singapore’s GDP growth forecast for 2024 to a more precise range of 2.0 to 3.0 per cent, refining the earlier estimate of 1.0 to 3.0 per cent. This forecast adjustment reflects the city-state’s economic performance in the first half of the year, alongside global economic conditions that influence Singapore’s trade-reliant economy.

Second Quarter Economic Performance

Singapore’s economy grew by 2.9 per cent year-on-year in the second quarter of 2024, maintaining a similar pace to the first quarter’s 3.0 per cent expansion. On a quarter-on-quarter seasonally-adjusted basis, growth stood at 0.4 per cent, consistent with the first quarter’s figure. The cumulative growth rate for the first half of 2024 averaged 3.0 per cent, which provides an optimistic backdrop for the revised annual forecast.

Key growth drivers in the second quarter included the wholesale trade, finance & insurance, and information & communications sectors, each contributing significantly to Singapore’s economic resilience. On the other hand, the manufacturing sector saw a 1.0 per cent contraction, primarily due to a downturn in the biomedical manufacturing segment, where a sharp decrease in pharmaceutical output impacted overall performance.

However, a positive note for the electronics sector emerged, as it returned to growth thanks to sustained demand for smartphone, PC, and AI-related chips, partially offsetting the manufacturing sector’s decline. Conversely, consumer-facing industries like retail and food & beverage services contracted, a trend partly attributed to an increase in outbound travel by residents.

Sectoral Outlook for 2024

Since MTI’s last economic report in May, Singapore’s major trading partners, such as the US and Malaysia, outperformed expectations, driven by strong domestic demand. Japan, however, experienced sluggish growth, weighed down by weak private consumption amidst declining real wages. Looking ahead, the US economy is anticipated to slow as consumer spending moderates, though investment in AI is expected to provide some support. In Europe, gradual growth is projected, bolstered by easing inflation and consumer spending recovery. Japan may see a slight rebound due to anticipated wage increases and easing inflation, which could support stronger consumption.

China, one of Singapore’s major trading partners, is expected to experience slightly slower growth in the second half of 2024. Investment activity may taper due to overcapacity concerns in certain sectors. However, a stabilizing property market and government support measures could help lift consumer sentiment, potentially driving modest consumption growth. Across Southeast Asia, domestic demand is likely to improve, particularly in the electronics and tourism sectors.

External Economic Risks and Resilience

While the external demand outlook remains relatively strong, MTI highlighted ongoing global risks that could challenge Singapore’s growth prospects. Geopolitical and trade conflicts pose a risk to business sentiment and could disrupt trade flows, leading to increased production costs. Additionally, financial market instability and tighter financial conditions could impede economic recovery efforts.

Amidst these global uncertainties, Singapore’s manufacturing sector, particularly the electronics cluster, is expected to see a gradual recovery in the second half of 2024. Demand for smartphone, PC, and AI-related components is projected to boost electronics, which in turn should support the precision engineering sector. Chemicals manufacturing is also expected to grow, benefiting from rising production in petrochemicals and specialty chemicals. However, biomedical manufacturing is likely to face ongoing challenges due to continued weak pharmaceutical output.

Trade-Related Services and Tourism Outlook

The anticipated recovery in the manufacturing sector, particularly in electronics, is projected to benefit trade-related services, including segments such as machinery and equipment within the wholesale trade sector. Additionally, Singapore’s tourism and aviation sectors are expected to see further growth due to rising global travel demand. This will likely positively impact tourism-related industries such as accommodation and air transport. Growth in the finance & insurance sector is projected to stay robust, supported by an easing of global interest rates amidst declining inflation pressures.

Taking into account the steady economic performance in the first half of 2024 and the global outlook, MTI has adjusted Singapore’s annual GDP growth forecast from “1.0 to 3.0 per cent” to a more precise “2.0 to 3.0 per cent.” This forecast reflects MTI’s confidence in Singapore’s economic resilience, balanced against potential global headwinds.

MTI’s refined 2024 GDP growth forecast reflects stable growth trends despite mixed performance across key sectors. With robust demand in wholesale trade, finance, and information sectors offsetting challenges in manufacturing, and a projected recovery in tourism, Singapore remains positioned for moderate growth. However, MTI cautions that geopolitical tensions and potential financial disruptions could impact global demand and influence Singapore’s growth trajectory.

Source: Ministry of Trade and Industry , Singapore